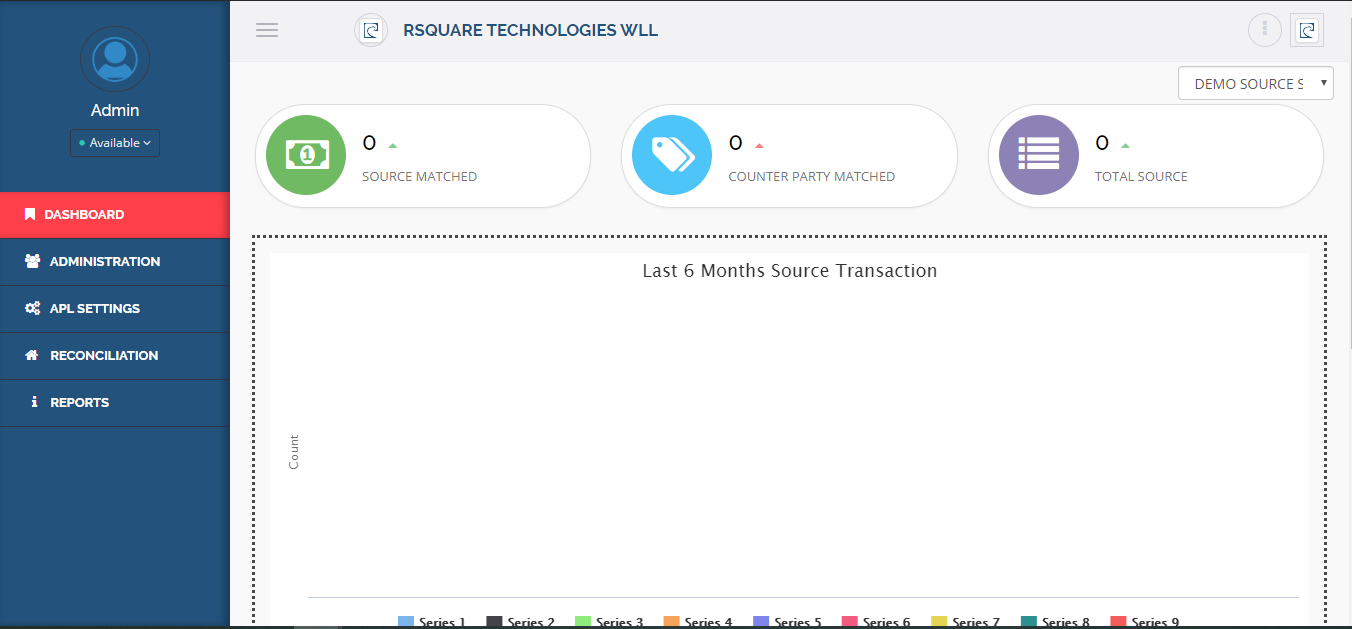

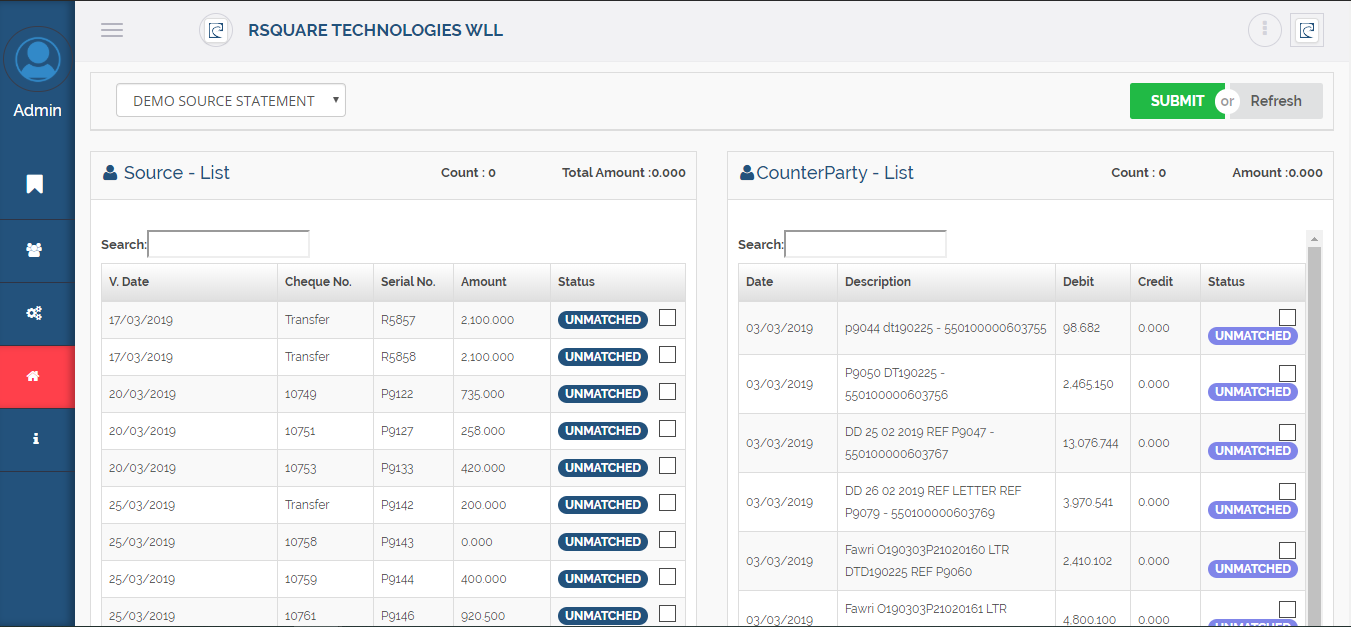

Our Easyrecon System shows the 360 Degree view of reconciliation Details.

EasyRecon

Reconciliations are performed daily, monthly or

quarterly based on whether an account is defined as

high, medium, or low risk. Typical high-risk accounts

include cash, trade receivables, payables, and financing

receivables are reonciled on daily basis. With our

EasyRecon software, reconcilation process can be done in

few seconds and releviing you with other duties.

Types of Reconciliations

- Bank reconciliation

- Vendor reconciliation

- Customer reconciliation

- Intercompany reconciliation

- Securites reconciliation

- Legal and Inheritance reconcilation

- Tax reconciliation

- ATM reconciliation

- Nostro reconciliation

BENEFITS

- No reconciliation errors.

- 100% consistent exception management.

- Reduced Human Errors

- Reduced financial risk.

- Reduce time.

- Removal of skilled employees from repetitive administration

- Improved and consistent dispatch performance regardless of business volume

FEATURES

- Two ways for document upload (1. Using Application / 2.Automatically taken from particular directory)

- Source and Counterparty Configuration

- Support Excel, Pdf, CSV

- Web based solution

- Access from any device

- Robotic Process Automation

- Dynamic Dashboard

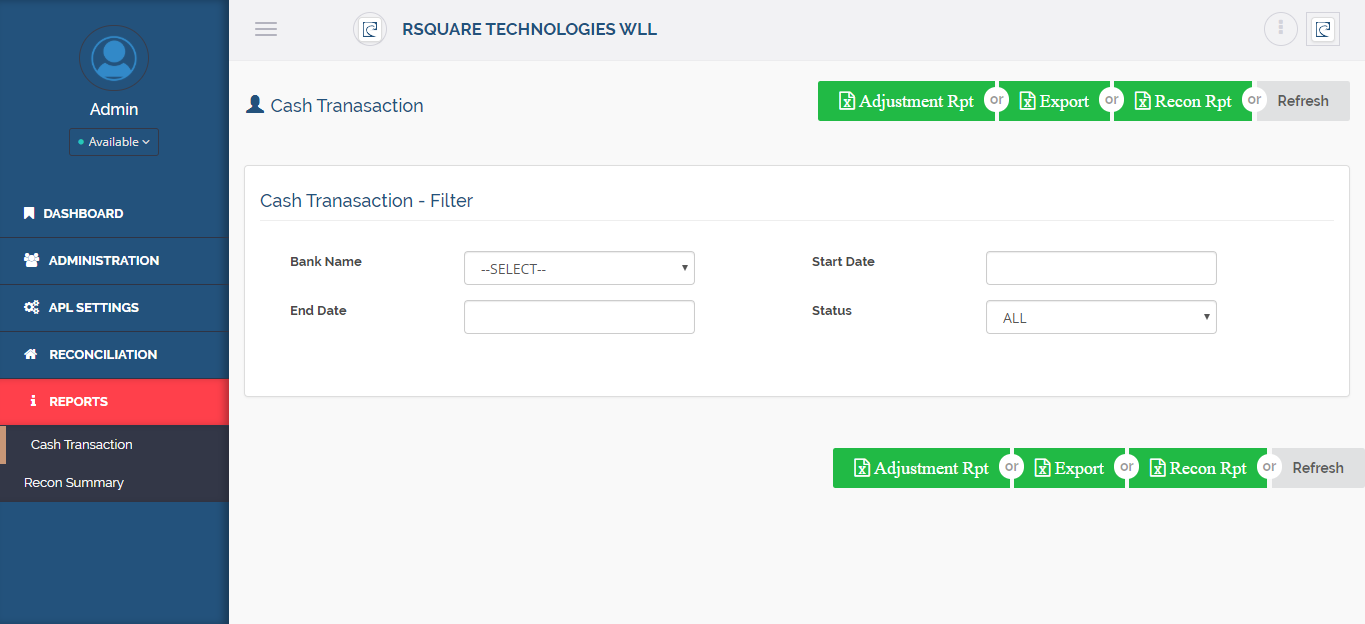

- Automatic Report Generation

- Manual Match

- Automatically report generated in particular directory